Table of Content

Once you refinance, you’ll continue to have a single mortgage. You don't pay back your loan unless you sell your home, move out for more than 6 months out of the year or pass away. If you sell the property, you would then use the profits from your home sale to pay back the loan. Just remember that these estimates aren’t always accurate and exist just to give you a rough idea of your home’s current worth.

As with a credit card, you only pay back what you borrow. So if you only borrow $20,000 on a kitchen renovation, that's all you have to pay back, not the full $30,000. Rocket Mortgage® doesn’t offer reverse mortgages at this time.

ways to get a lower monthly cost

For line amounts greater than $100,000, maximum combined loan-to-value ratios are lower and certain restrictions apply. For line amounts greater than $500,000, maximum combined loan-to-value ratios are lower and certain restrictions apply. We've got all kinds of free mortgage calculators to help you pick the right home loan for your family.

Don’t deal with any lender who tells you not to read the financing disclosures. The law says you must get them, so make sure you do — and be sure to read and understand them before you sign for the financing. How to protect your personal information and privacy, stay safe online, and help your kids do the same.

Options For Borrowing Against Home Equity

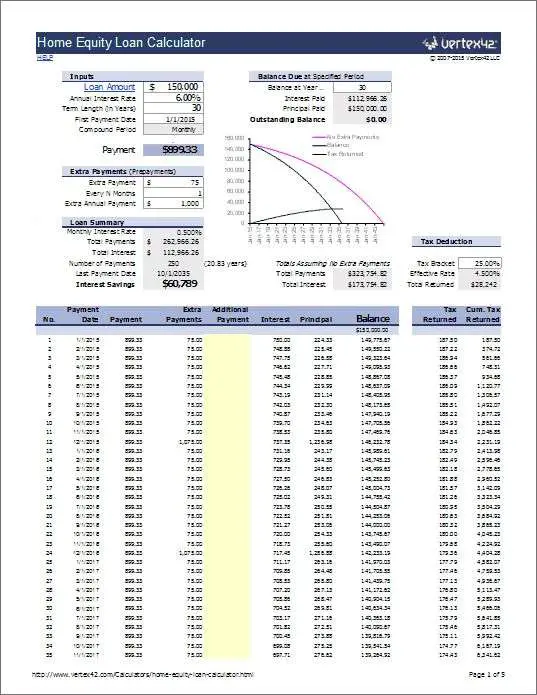

Ensure your extra payments get credited correctly to pay down principal. You may be tempted by offers allowing you to borrow up to 120% of your home’s equity. Be aware any interest above the home’s equity limit isn’t tax deductible. Additionally, you won’t be able to sell your home until the lien is satisfied, which can negatively impact the marketability of your home.

Home equity is the calculation of a home's current market value minus any liens attached to that home. Matt Webber is an experienced personal finance writer, researcher, and editor. He has published widely on personal finance, marketing, and the impact of technology on contemporary arts and culture. Idaho Central Credit Union is federally insured by the National Credit Union Administration.

Business Banking

It's easy to pay down a home equity loan or home equity line of credit by adding extra money to your monthly payment. Indicate on your check and enclosed statement that the extra money should go toward the principal. When the loan balance reaches 80% of the home's original value, the borrower has the right to request the cancellation of PMI.

Previously, she wrote about personal credit for Bankrate and CreditCards.com. She is passionate about providing accessible content to enhance financial literacy. She graduated from the University of Texas at Austin with a bachelor's degree in journalism, and has worked in the newsrooms of KUT and the Austin Chronicle. When not working, she is probably paddle boarding, hopping on a flight or reading for her book club.

The second way that homeowners can use their home equity to pay down their mortgage is by taking out a home equity line of credit . As its name implies, HELOCs are a line of credit that is secured by your home. Like a second mortgage, the amount of money that you can borrow under a HELOC is calculated by taking a percentage of your home equity, typically similar to that which is used for second mortgages.

To receive the full tax benefit, the total debt on your home, including the home equity loan, cannot exceed the market value of the home. Building equity in your home is one of the best ways to add to your overall wealth and still enjoy the benefits of being a property owner. There are a few different ways to calculate your home equity, but the most common method is to subtract the amount of money you still owe on your mortgage from the current value of your home. You can estimate your home’s value by looking up recent sales of similar homes in your area or by talking to a real estate professional. Once you have that number, subtract any outstanding mortgage balance or other liens on your property.

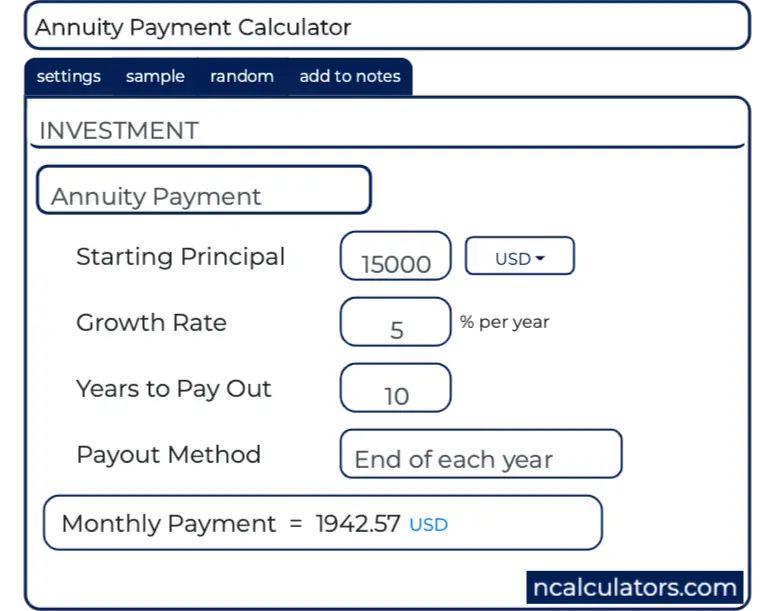

The calculator returns your estimated monthly payment, including principal and interest. Enter your loan amount, term and interest rate to estimate your monthly payment. To borrow $500,000, for example, you have to have a lot of equity in your home, and your home has to be worth quite a lot of money. On a $100,000 loan, for example, one point would cost you $1,000.

The remaining total is the amount of equity you have in your home. Keep in mind that each lender charges different amounts for home equity loan fees, and some lump multiple types of fees together. Some lenders even offer no closing cost home equity loans, which prevent upfront costs but can result in a higher interest rate for the life of the loan. To begin with, HELOCs do not give the lender a lump sum at the start of the loan. Instead, they function like a personal line of credit, allowing the homeowner to borrow up to a certain amount, but letting them decide when and how much to borrow. This makes HELOCs well suited for homeowners who want the option of borrowing against the equity in their home without having any immediate plans for how to use the money.

No comments:

Post a Comment